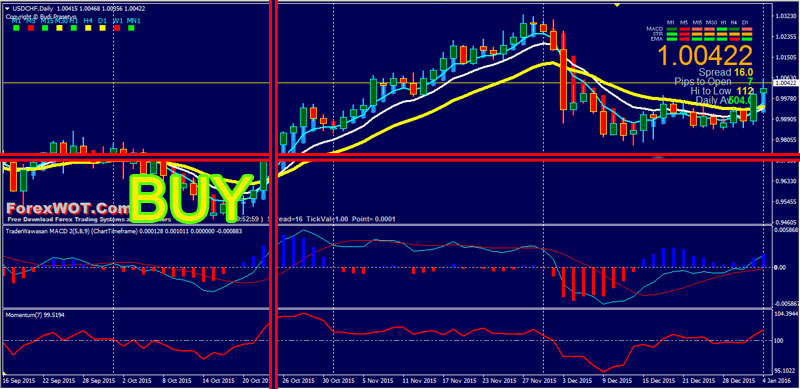

Let's see the chart below to better understand the strategy. If you find a swing low nearby, place a stop loss order a few pips below it.

#100 AND 200 EMA CROSSOVER HOW TO#

Now that you get the main ideas of using three EMAs, let's take a look at how to use them in the chart. See Also: Trading Strategy Using 3 Bar EMA If the 10 EMA crosses below the 30 EMA which lies above the 50 EMA, this is a possible signal that a longer-term uptrend is reversing into a longer-term downtrend.

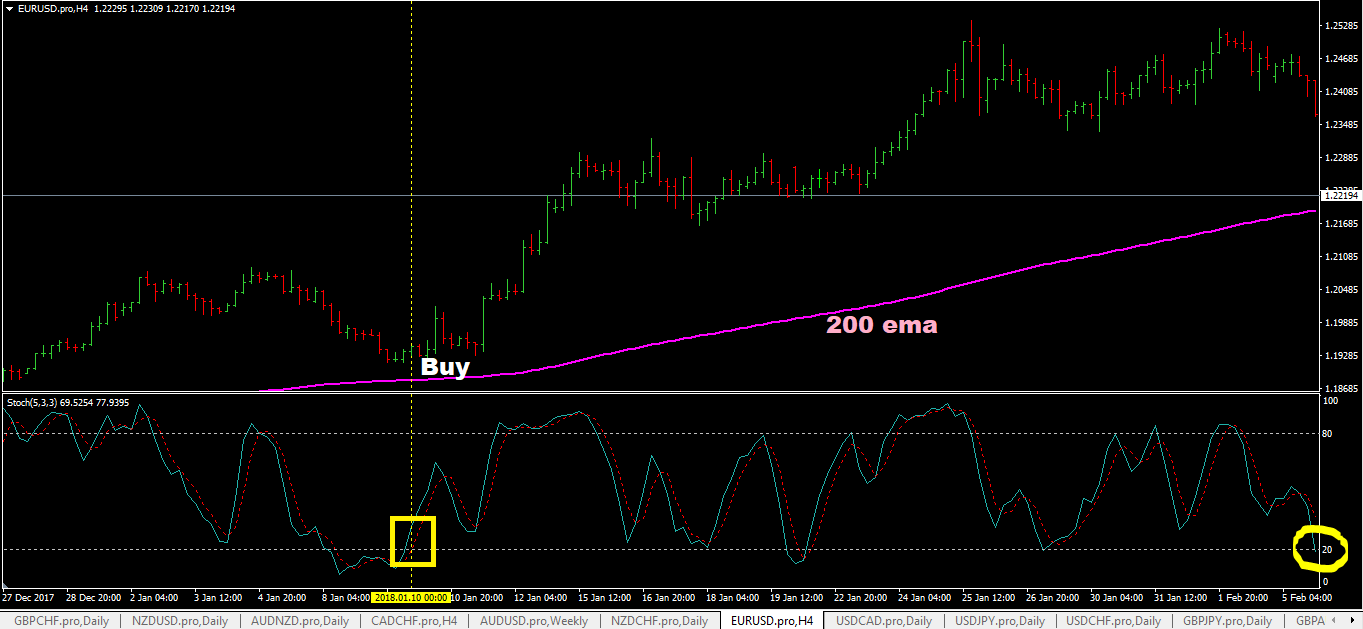

If the 10 EMA crosses above the 30 EMA which lies below the 50 EMA, this signals a longer-term downtrend is potentially reversing into a longer-term uptrend.If the 10 EMA crosses below the 30 EMA which is positioned below the 50 EMA, this is a signal for you to enter a short position. If the 10 EMA crosses above the 30 EMA which is positioned above the 50 EMA, this is a signal for you to enter a long position.Subsequently, if the price moves below the 50 EMA, this is a potential signal of reversal from a longer-term uptrend into a downtrend. If the 50 EMA is above the 10 and 30 EMA, this indicates that the market has lost short-term momentum.Contrarily, if the price is below all the EMAs, this indicates a downtrend and falling momentum. If the price is above all the EMAs, this indicates an uptrend and rising momentum.Now, see the position and movement of each EMA and compare it with the other EMAs and/or the price action. In this case, we will use a 10-day, 30-day, and 50-day EMA. After that, you may activate the three EMAs on the chart. The first thing you should remember is that this strategy is best applied to trending markets. The long-term 50 EMA, signaling the longer-term trend.The medium-term 25 or 30 EMA, defining the zones of value.The short-term 10 EMA, acting as the momentum indicator.The three EMAs involved in this strategy are: Revealing the Ultimate 3 EMA Crossover Strategy In this article, we will discuss two strategies that involve 3 EMA crossover. See Also: A Trader’s Guide to EMA Strategy For example, if the price is below the 10 EMA but above the 50 EMA, this can be a signal of a trend reversal.

We can also confirm whether the short-term EMA has the same trend direction as the long-term EMA and whether it has the momentum to continue moving in that direction. Since the three EMAs display the direction of trend and momentum, we can create our risk to reward ratio by using stop losses, trailing stops, and profit targets. This means that when the price strays too far, it will eventually return to the medium-term EMA line. Meanwhile, the medium-term EMA indicates a zone of values for possible mean reversion. A crossover between the short-term EMA and long-term EMA serves as a signal to enter a position. These EMAs can also be used to define the best entry and exit levels since the three indicators represent the market trend and price momentum on the chart.

Three EMAs crossing above the price at the same time is a strong bullish signal, while three EMA crossing below the price at the same time is a strong bearish signal. It can also give a better context to the price action in relation to the three EMA lines displayed on the chart. The three EMAs can give stronger confirmation than just two EMAs crossover.

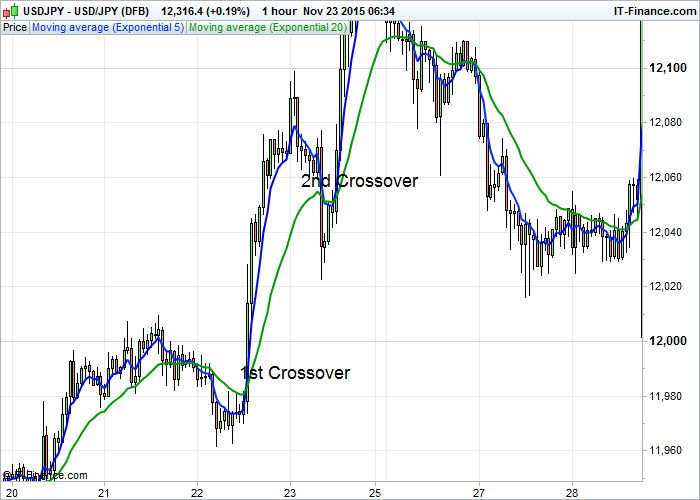

See Also: Practical Use of Moving Averages: EMA-20 and EMA-60 Crossover Notice how after the first crossover the price starts to move down but reverse to the upside after the second crossover. On the USD/JPY chart above, we can see crossovers between the 5 EMA and 20 EMA. That being said, the crossover might actually give a signal that a trend could be ending and will soon be replaced by a new trend. The crossover doesn't predict future trends, but rather shows the ongoing direction of a trend. An EMA crossover occurs when two different EMA lines cross one another.

0 kommentar(er)

0 kommentar(er)